Westmark Capital Has Custom Funding Solutions for Your Industry

Our approval process is simple.

- Or Call Us Today

Business Funding Solutions with Invoice Factoring

Get approved within 24-72 hours.

INVOICE FACTORING

Insufficient cash flow can hinder your operations and growth whether you are a new company or an established business. Some banks and funding providers may not see your accounts receivable as an asset for funding purposes, but we do! Leveraging your customer invoices with Westmark Capital with invoice factoring can improve your cash flow greatly.

We will advance as much as 80 to 90% of your customer open invoices. Invoice factoring is not a loan and does not show up on your balance sheet. Factoring for construction companies is beneficial for companies whose clients pay on net terms. Westmark Capital provides funds in advance instead of waiting 30 to 60 days for payment.

INCREASE CASH FLOW WITH INVOICE FACTORING

Construction

Many of the following types of heavy construction contractors can benefit from invoice factoring:

- Drilling

- Hauling

- Excavating

- Grading

- Crane Operators

- Demolition

- Trenching

- Welding

- Electrical

- Concrete

INCREASE CASH FLOW WITH INVOICE FACTORING

Medical & Physicians

Many of the following types of medical industries can benefit from invoice factoring:

- Medical Services

- Nursing Homes

- Chiropractor Clinics

- Business Acquisitions

- Massage Therapist

- Dental Clinics

- Internists

- Dermatologists

- Pediatricians

INCREASE CASH FLOW WITH INVOICE FACTORING

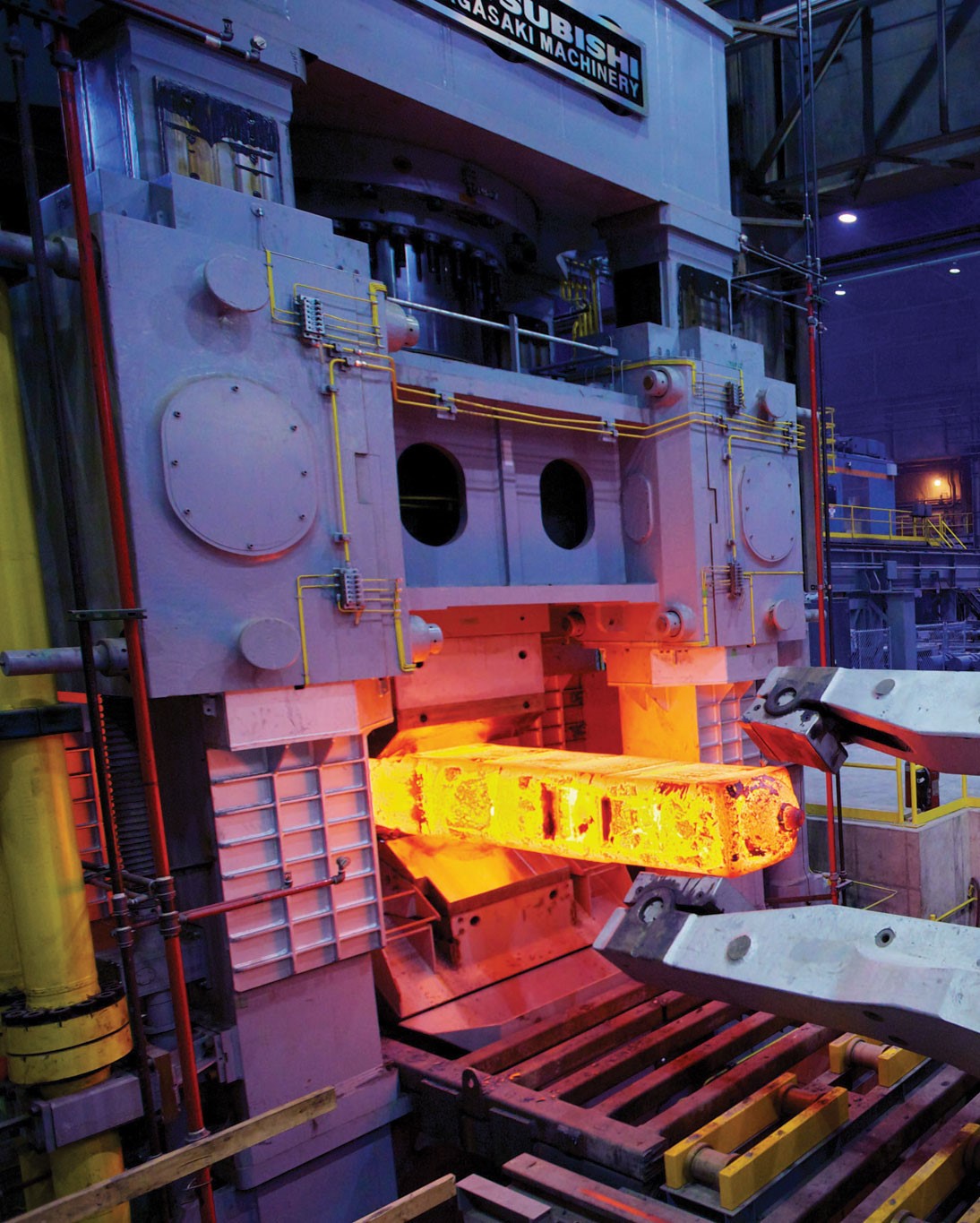

Manufacturing

Many of the following types of manufacturing can benefit from invoice factoring:

- Food & Beverage

- Textiles & Apparel

- Defense & Aerospace

- Wood, Paper, & Printing

- Petroleum & Chemicals

- Machinery

- Metal Fabrication

- Plastics

- Computer & Electronics

- Electrical

- Applicances

- Computer & Electronics

Custom Funding Solutions for Your Industry

Westmark Capital will help your business with the right funding solution.